Onsurity, an Indian start-up that supplies month-to-month subscription-based insurance coverage options to mini, tiny as well as moderate companies, start-ups as well as expanding services, has actually increased $24 thousand in a financing cycle led due to the Globe Banking company’s International Money management Enterprise (IFC).

The Collection B cycle likewise viewed the involvement coming from existing entrepreneurs Nexus Project Allies as well as Quona Funding. Along with the clean financing, the three-year-old start-up has actually increased $40 thousand in complete.

India has more than 63 thousand mini, tiny as well as moderate companies (MSMEs), dealing with near to 400 thousand workers as well as assisting 675 thousand loved ones. Nevertheless, standard gamers primarily provide electric motor, retail health and wellness as well as sizable company insurance coverage courses to serve a bigger populace. One vital explanation for the well established insurance provider certainly not to concentrate on venture clients is actually the nation’s reduced seepage of insurance coverage as a whole. Depending on to the authorities’s Financial Questionnaire 2022–23, insurance coverage seepage in India was actually 4.2% in 2021.

Onsurity targets to fill up the space along with its own room of offerings created particularly for MSMEs companies as well as arising services. It likewise incorporates medical care as well as health perks to permit companies — irrespective of their measurements — permit their workers to get access to health and wellness check-ups, physical fitness registration, physician examination as well as marked down medications, and many more solutions.

Further, the Bengaluru-based start-up just recently grew its own product through presenting cyber danger insurance coverage to permit services safeguard their on the web existence along with committed protection versus personal privacy as well as protection break circumstances. It likewise supplies various other company items consisting of D&O obligation insurance coverage as well as business overall insurance coverage under Onsurity And also.

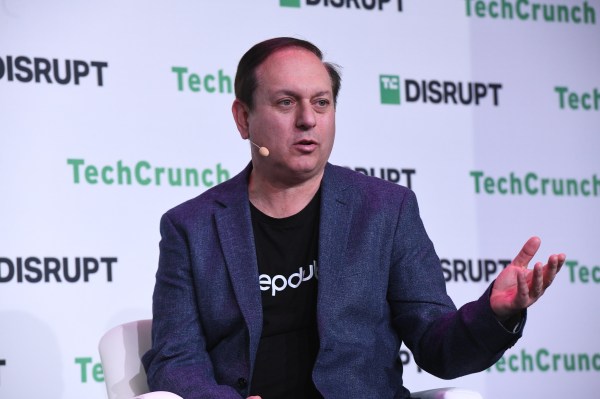

“Our team are actually certainly not taking on sizable insurance coverage gamers or even sizable reps in India to take our room. Our team are actually simply generating our personal type,” mentioned Yogesh Agarwal, owner as well as chief executive officer of Onsurity, in a meeting.

Agarwal formed the start-up together with Kulin Shah (COO) in February 2020. Each founders possess expertise operating in the insurance coverage industry. Agarwal formerly operated at Universal Sompo General Insurance Coverage as well as Shriram General Insurance Coverage, while Shah invested over pair of as well as a fifty percent years as bad habit head of state at Acko General Insurance coverage.

Onsurity partners with around 5 insurance coverage companions as well as 4 to 5 providers in the medical care as well as health solutions room. Agarwal mentioned the start-up has actually partnered along with a number of the planet’s best reinsurers, without revealing their labels.

“Our team partner with insurance provider, where our company can possibly do a deep-seated combination along with all of them when it involves installing insurance coverage in our total feline,” Shah informed TechCrunch.

Onsurity has actually likewise begun partnering along with health centers straight, along with much more than one hundred health centers presently onboarded, to reduce in addressing client cases as well as improve its own medical care combination.

“By the end of the time, if I don’t obtain an excellent cases expertise coming from my insurer, my religion in insurance coverage is actually shed,” Shah mentioned.

Traditional insurance firms consisting of ICICI Lombard as well as Tata AIA likewise possess details insurance coverage offerings for MSMEs in the nation. Nevertheless, Agarwal mentioned Onsurity supplies a total bundle, along with health and wellness, lifestyle as well as unintentional insurance coverage, along with accessibility to health and wellness check-ups, teleconsultations, as well as OPD perks, to provide an unique expertise to venture clients.

The start-up has actually likewise created its own options readily available to companies along with crews as tiny as 3 or even 7 individuals, unlike well established insurance provider, Shah included.

Currently, Onsurity provides over 5,000 venture clients, reaching out to over a thousand individuals throughout 26 Indian conditions as well as 3 union areas. Its own participants feature company managers, start-up workers as well as job laborers along with their dependents. As long as 80% of Onsurity’s complete profile makes up SMEs, along with over half its own participant bottom comprised of middle-class laborers as well as near to 40% arising from tier-II as well as tier-III metropolitan areas.

Onsurity has actually changeover $12 thousand (one hundred crores Indian rupees) in yearly earnings as well as is actually forecasting 10x development over the following pair of years. Given that its own Collection A backing in 2021, the start-up has actually found a 17x rise in earnings, every the founders.

“There is actually a precise road to earnings, offered the sort of no charge of accomplishment that our company possess as well as our one-of-a-kind circulation networks,” Shah mentioned.

With the clean funds, Onsurity targets to expand its own client bottom to over 50,000 providers, delivering protection to over 5 thousand lifestyles through 2026. The start-up likewise considers to remain to purchase modern technology to remain applicable in the competitors as well as create it much easier for its own participants to obtain settlement deals. In addition, it is actually seeking to develop an artificial intelligence motor to recognize the appropriate item to recommend to details SME clients through calculating their dangers. There are actually likewise considers to improve its own outreach as time go on as well as get to even more clients, Agarwal informed TechCrunch.

“The supply of insurance policy protection is actually crucial for economical danger control as well as strengthening social protection. Our latest financing highlights our commitment to a modern technology system that enhances ease of access of employer-sponsored health plan solutions,” mentioned Wendy Werner, IFC nation scalp, India, in an equipped declaration. “Out-of-pocket medical care expenditures could be a substantial trouble for workers of SMEs. Health plan aids SMEs handle their expenditures while assisting their workers.”

Onsurity possesses a staff measurements of 300 workers, along with twenty% situated in metropolitan areas apart from Bengaluru. It considers to choose even more individuals to boost its own existence as time go on.