Mercury Fund, an early-stage project company, shut on $160 thousand in resources dedications for its own 5th fund, additionally its own most extensive.

In general, it’s been actually an occupied month for equity capital agencies declaring brand new resources dedications. Mercury Fund participates in agencies, consisting of Lore Ventures, Hook Up Ventures, Fuse and also Unconventional Ventures, in declaring brand new funds this month.

Having been actually around for a many years currently, the company was actually formerly called DFJ Mercury. In 2013, it tackled the Mercury Fund name when Draper Fisherman Jurvetson reorganized its own facilities. Today, Mercury Fund has actually aided produce greater than $9 billion of organization worth around its own profile of over fifty providers.

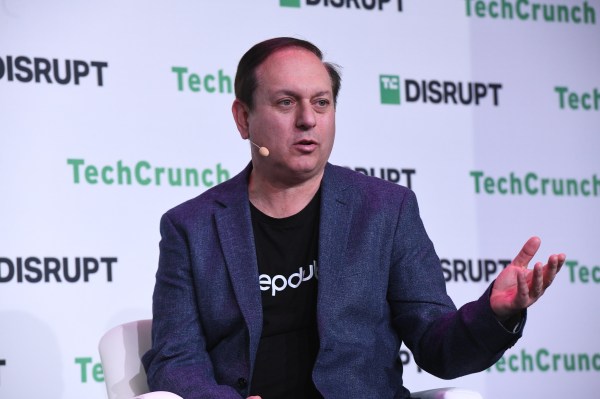

This 5th fund possessed a first aim at of $150 thousand and also is actually supported through existing real estate investors and also brand new restricted companions, consisting of educational institution foundations, structures and also loved ones workplaces. Much of the brand new real estate investors are actually located in the main USA where Mercury puts in, Blair Garrou, founder and also taking care of supervisor of Mercury Fund, informed TechCrunch.

Houston-based Mercury Fund normally lifts every 3 to 4 years to provide opportunity to release the resources, Garrou claimed.

“Some funds before have actually taken longer to lift, yet this set really wasn’t virtually as long,” Garrou included. “That was because of the functionality of our previous fund. Our team shut straight just before COVID, yet our company placed it to operate in the course of COVID. Our team possessed some definitely terrific providers during that exciting pattern, consisting of Cart.com, Otto and also Sign Advisors.”

Finding SaaS opportunities

The company’s style features acquiring creators developing transformational SaaS and also records systems in much smaller innovation markets away from the seaside specialist centers. There are actually locations where they don’t possess the type of start-up ecological communities or even sources as their equivalents on the shoreline.

In referring to where chances are actually for SaaS in those locations, Garrou claimed over 5 years back, there was actually extra concentrate on business-to-business as it associates with commercial SaaS. As an example, the auto, food items and also drink and also power business.

Today, the focus performs upright SaaS and also business people taking control of the individual knowledge. As an example, Garrou observed that in Otto as well as additionally in RepeatMD, among its own assets coming from the brand new fund. RepeatMD is actually a Houston-based person interaction and also fintech system for medical professionals marketing non-insurance paid items.

“You’re beginning to observe these sets of task of definitely prosperous providers getting the SaaS script and also driving that ahead,” Garrou claimed. “Back in fund 3, our company were actually virtually totally B2B. That’s currently increased right into B2B, B2C and also records systems for fund 5.”

Therefore, Mercury has actually developed an operationally-focused assets style that assists deliver those sources therefore profile providers can easily extra swiftly expand.

A ‘center United States’ fund

Mercury Fund was actually rearing for its own 5th fund in 2021, while releasing resources coming from its own 4th fund, which Garrou claimed “was our finest doing fund today.” That year, the company’s profile had more than 10 departures, he included, which appeared to create the restricted companions incredibly satisfied.

Garrou illustrated the fundraising atmosphere as “rather sturdy,” taking note that the company’s style entered maturation in the course of that opportunity. When financing took a slump in 2022, Garrou returned to Mercury’s LPs to resume chats, and also certainly not merely performed the LPs stick to all of them, yet some increased adverse their preliminary assets.

And, as soon as the economic slump duration started, Mercury, actually collaborating with its own providers to become resources dependable, was actually definitely desirable to institutional real estate investors, Garrou claimed.

“Being actually a ‘center United States’ fund, it’s consistently daunting increasing resources equivalents, yet our style is actually simply various,” Garrou included. “Throughout COVID is actually when our company observed combination job end up being the rule, and also providers might work with ability coming from anywhere and also lift resources coming from anywhere. That definitely agreed with our fund being actually incredibly operationally-focused.”

In enhancement to RepeatMD, Mercury has actually brought in 7 assets coming from the 5th fund up until now. Garrou anticipates to produce in between 18 and also twenty assets generally. Others consist of Polco, a neighborhood interaction ballot system for neighborhood and also condition federal governments located in Wisconsin, MSPbots, a Chicago-based AI-driven procedure computerization system for little and also mid-sized handled provider, and also Brassica, an economic framework innovation provider building organization answers for different possessions, located in Houston and also Cheyenne, Wyoming.

“Our team anticipate to carry out an additional a couple of years of spending throughout this fund,” Garrou claimed. “At that point our chance is actually that our company’ll possess an additional terrific assets duration in 2025 like our company invited 2021. If therefore, our company’d really love to elevate once more a long time afterwards.”

Have a juicy idea or even lead concerning happenings in the project globe? Send out pointers to Christine Venue at chall.techcrunch@gmail.com or even Sign at 832-862-1051. Privacy demands will certainly be actually appreciated.

https://chillinncambodia.com/deciphering-the-dollar-index/

https://largestartwork.org/exploring-the-world-of-forex-brokers/

https://milliondollardrew.com/mastering-the-art-of-cfd-trading/

https://impregnantnow.org/strategies-for-playing-forex-successfully/

https://catcthemes.com/the-metatrader4-mt4-app-trading-on-the-go/

https://enteratecaracas.com/analyzing-forex-stocks-a-comprehensive-approach/

https://waimeachocolatecompany.com/forex-analysis-techniques-for-profitable-trading/

https://insanityworkouttorrent.org/exploring-the-metatrader4-platform/

https://olbermann.org/mastering-the-mt4-platform-for-forex-trading/

https://occupynorwich.org/choosing-the-right-forex-broker-for-your-needs/

https://2dayhangover.com/cfd-stocks-a-unique-investment-opportunity/

https://nursethebuzz.com/risk-management-in-forex-trading/