Mesh (in the past Front Finance), a start-up cultivating a company to aid clients move as well as take care of electronic properties like crypto, has actually increased $22 thousand in a Series A backing cycle led through Money Forward along with involvement coming from Galaxy, Samsung Next, Streamlined Ventures, SNR.VC, Hike VC, Heitner Group, Valon Capital, Florida Funders, Altair Capital, Network VC as well as different angels.

Mesh will definitely make use of the brand new money, which carries its own overall increased to day to $32 thousand, to more establish its own resources for down payments, remittances as well as payments, founder as well as CEO Bam Azizi states, too sustain its own go-to-market functions.

“Consumers are actually more and more concentrated on digital-first expertises when it relates to their loan — whether it’s electronic banking or even a collectible possession,” Azizi said to TechCrunch in an e-mail job interview. “Mesh is actually transforming the hookup level that’s important to promoting these digital-first consumer expertises, offering customers the potential to accessibility as well as relocate their loan by themselves conditions.”

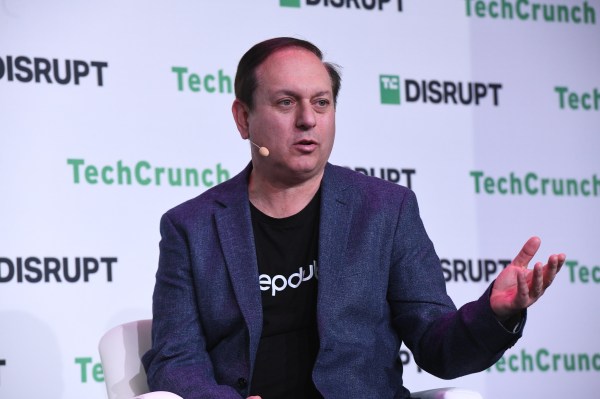

Mesh, an attendee in the Startup Battlefield 200 competitors at TC Disrupt 2023, was actually started in 2020 through Azizi as well as Adam Israel. Before beginning Mesh, Azizi introduced the cybersecurity as well as identification provider NoPassword, which LogMeIn obtained in 2019. Israel originated from the financial industry, having actually operated at HSBC as a regulating supervisor.

Azizi as well as Israel invested numerous years developing the primary facilities for Mesh prior to spinning it out, together with the provider’s business-to-business offerings, in September 2022, along with the objective of creating Mesh the “advanced beginner hookup level” in between non-traditional properties.

Businesses may make use of Mesh to permit their clients relocate properties — consisting of crypto — around various systems. As well as customers may link various possession courses as well as profiles securing those properties along with read, compose as well as move abilities to Mesh, possessing the system accumulation each of their profiles.

Mesh sustains in-app transmissions of properties around trades as well as purses, plus remittances as well as payments of crypto. Azizi claims that Mesh doesn’t hold customers’ individual details or even qualifications, maintains move places confidential coming from the viewpoint of exterior profiles as well as doesn’t in fact contact properties, offering a solely straight account-to-account move.

“Mesh’s connect as well as participate in remedy is actually specifically convincing for those companies that desire to offer even more interoperability to their customers however are actually certainly not able to develop the APIs from the ground up for each system,” Azizi pointed out. “Our team wish Mesh to become current in each and every purchase that takes place in the electronic planet as well as create it even more safe, certified as well as easy to use.”

Is Mesh even more safe, certified as well as easy to use than what’s on the market? Possibly. All the same, Mesh’s purchases sound shows up to have actually swayed a reputable variety of clients — the provider professes to possess 70 paying for customers around the money as well as electronic properties sectors.

Certainly, it’s a huge addressable market. Numerous folks worldwide, consisting of 16% of grown-up Americans, have actually bought electronic properties, which got to a market capital of $3 mountain worldwide final November. Capitalists in Mesh are actually no question fishing for a piece of that cake.

“With this current financing, our team reside in a surprisingly powerful area to perform versus our lasting concept,” Azizi pointed out.